Top 30 Forex Brokers Fundamentals Explained

Top 30 Forex Brokers Fundamentals Explained

Blog Article

The 20-Second Trick For Top 30 Forex Brokers

Table of ContentsTop 30 Forex Brokers for BeginnersThe Top 30 Forex Brokers IdeasSee This Report on Top 30 Forex BrokersNot known Factual Statements About Top 30 Forex Brokers About Top 30 Forex BrokersIndicators on Top 30 Forex Brokers You Need To KnowThe Greatest Guide To Top 30 Forex BrokersTop 30 Forex Brokers - An Overview

Each bar graph represents one day of trading and contains the opening price, highest rate, cheapest price, and shutting cost (OHLC) for a trade. A dash on the left stands for the day's opening price, and a similar one on the right represents the closing rate.Bar charts for currency trading help investors recognize whether it is a purchaser's or vendor's market. Japanese rice traders initially utilized candle holder charts in the 18th century. They are aesthetically much more appealing and much easier to read than the graph kinds explained over. The upper section of a candle is utilized for the opening rate and greatest price point of a currency, while the reduced portion suggests the closing cost and most affordable cost factor.

Not known Facts About Top 30 Forex Brokers

The formations and shapes in candle holder graphes are used to determine market direction and motion.

Banks, brokers, and suppliers in the foreign exchange markets permit a high quantity of leverage, indicating investors can manage large placements with fairly little cash. Utilize in the variety of 50:1 prevails in foreign exchange, though even better amounts of leverage are available from particular brokers. However, leverage has to be utilized meticulously because lots of unskilled traders have actually endured considerable losses using even more leverage than was essential or sensible.

Our Top 30 Forex Brokers Statements

A money trader needs to have a big-picture understanding of the economic situations of the numerous nations and their interconnectedness to grasp the basics that drive money worths. The decentralized nature of foreign exchange markets means it is less regulated than other monetary markets. The degree and nature of policy in forex markets depend on the trading territory.

Forex markets are among one of the most fluid markets in the globe. So, they can be less volatile than other markets, such as real estate. The volatility of a particular currency is a function of multiple aspects, such as the national politics and economics of its country. Events like economic instability in the form of a settlement default or inequality in trading connections link with another money can result in significant volatility.

Things about Top 30 Forex Brokers

Money with high liquidity have a prepared market and show smooth and predictable price activity in response to outside events. The U.S. buck is the most traded money in the globe.

What Does Top 30 Forex Brokers Mean?

In today's details superhighway the Foreign exchange market is no much longer exclusively for the institutional investor. The last 10 years have actually seen a rise in non-institutional investors accessing the Forex market and the advantages it uses.

The 7-Second Trick For Top 30 Forex Brokers

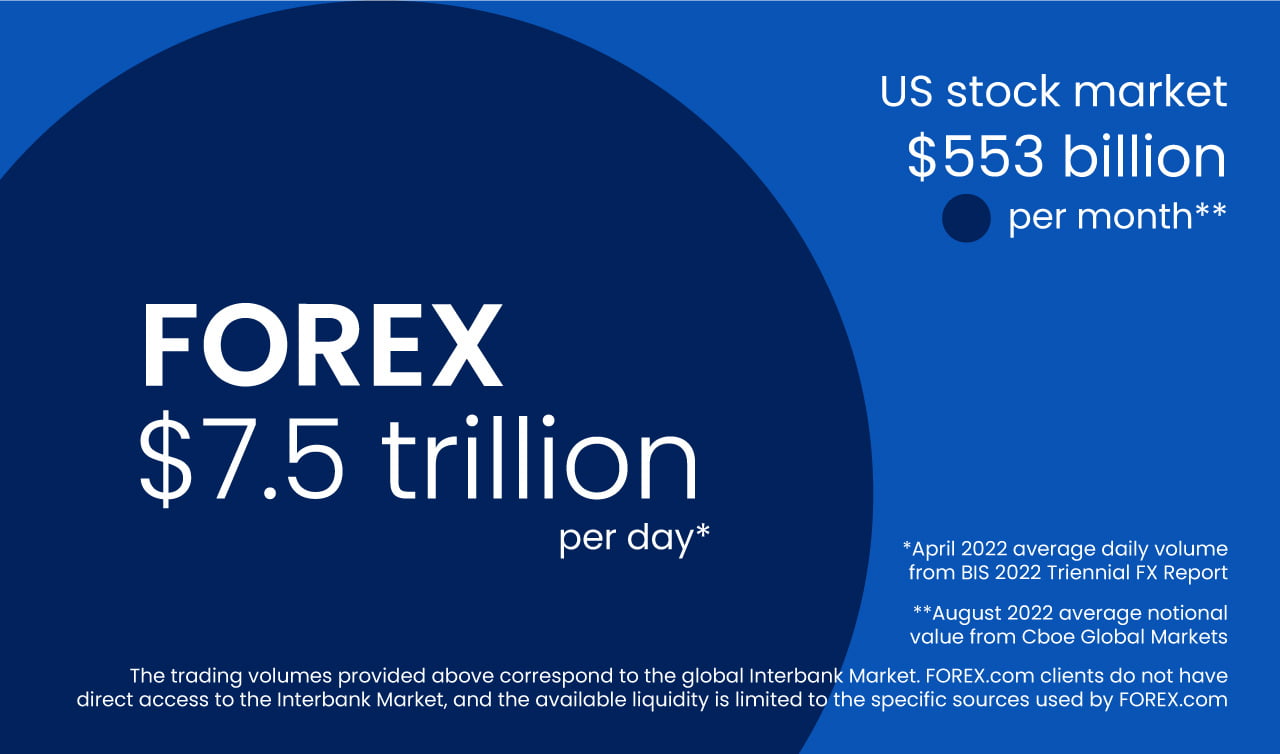

International exchange trading (forex trading) is a worldwide market for acquiring and marketing money - XM. 6 trillion, it is 25 times larger than all the world's stock markets. As an outcome, rates transform constantly for the currencies that Americans are most likely to make use of.

When you offer your money, you receive the payment in a various currency. Every tourist who has obtained international money has done foreign exchange trading. The investor purchases a particular money at the buy price from the market maker and offers a various money at the selling cost.

This is the transaction cost to the trader, which subsequently is the revenue earned by the market manufacturer. You paid this spread without understanding it when you traded your dollars for foreign money. You would discover it if you made the purchase, terminated your journey, and after that tried to trade the money back to bucks immediately.

Not known Details About Top 30 Forex Brokers

You do this when you believe the money's value will certainly fall in the future. Companies short a money to protect themselves from threat. Shorting is really risky. If the currency increases in value, you have to get it from the dealership at that rate. It has the same advantages and disadvantages as short-selling stocks.

Report this page